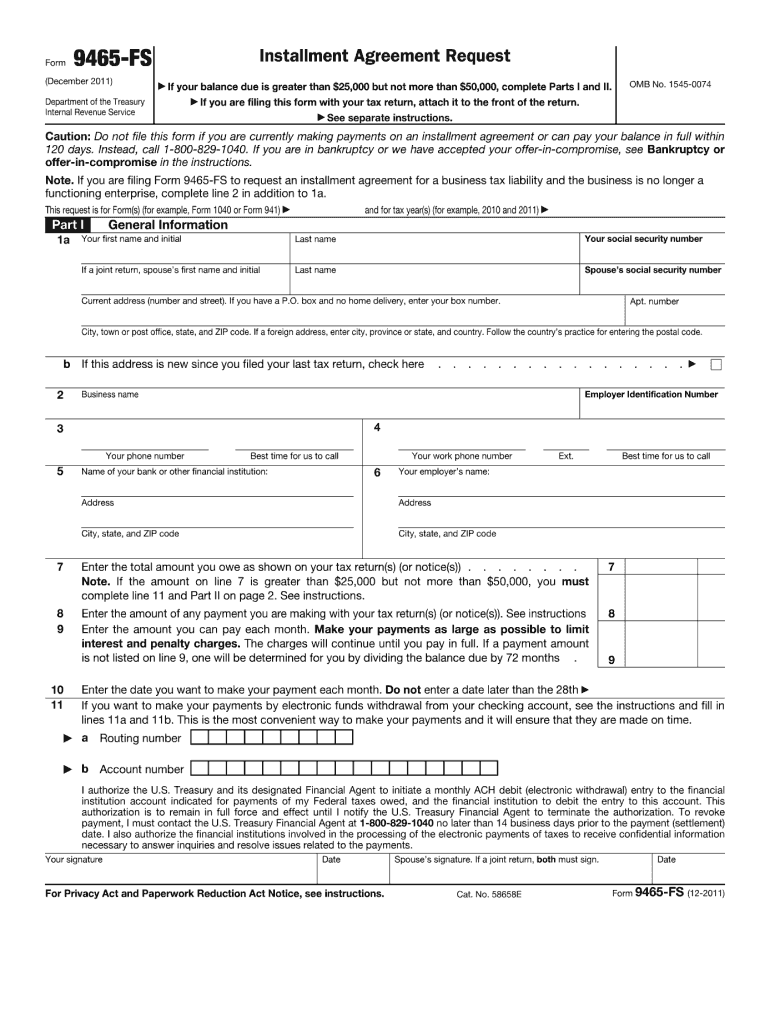

Who needs an IRS Form 9465-FS?

The IRS Form 9465-FS serves as the Installment Agreement Request that is to be used by individuals as an application for monthly installment plan, who:

- Owe income tax on Form 1040 to the IRS,

- May be in charge of a Trust Fund Recovery Penalty,

- Were self-employed and owe self-employment or unemployment taxes and aren’t operating the business anymore,

- Are personally responsible for a partnership liability while the partnership isn’t operating at the present, or

- Are personally responsible for taxes in the name of a limited liability company (LLC) and the LLC isn’t operating anymore.

What IRS Form 9465-FS is for?

The Form was created in order to be used by taxpayers in case they cannot afford to pay their taxes in full. If this is the case, a taxpayer should file the Installment Agreement Request, if their liability is greater than $25,000 but does not exceed $50,000.

Is Installment Agreement Request form 9465 accompanied by other forms?

Generally, the printable IRS Form 9465-FS should be filed as an accompaniment to the Individual Income Tax Return, so it is to be attached to such forms as Form 1040 and Form 941.

In order to reduce the fee, there is a need to support the 9465-FS by Form 13844 (Application For Reduced User Fee For Installment Agreements). Also, if you want to make your payments by payroll deduction, you should attach a completed Form 2159.

If not along with the Tax Return, the Installment Agreement Request can also be filed separately.

When is Form 9465-FS due?

As it has been mentioned the filled out and submitted by the Tax Day, when the tax returns are due.

How do I fill out IRS Form 9465-FS?

This tax form 9465 consists of two parts, each of which specifies certain information about the nature of your debt. To help you fill out the form properly there are comprehensive comments and instructions accompanying every item to indicate.

Where do I send IRS Form 9465-FS?

The completed 9465-FS Request form should be directed to the local IRS office.